What is Wave theory

Wave theory has been a popular tool used by traders and investors to analyze and predict market movements. It is based on the idea that market movements follow a wave-like pattern, with cycles of highs and lows that can be analyzed and predicted using specific technical indicators. In this post, we will explore some of the key principles of wave theory and how it can be used to trade financial markets.

Principle 1: Markets move in waves

The first principle of wave theory is that markets move in waves. These waves can be observed in the charts of various financial instruments, and they tend to occur in a repetitive pattern. The pattern can be divided into two types of waves: impulse waves and corrective waves. Impulse waves are the larger waves that trend in the direction of the overall market trend, while corrective waves are smaller waves that move in the opposite direction of the market trend.

Principle 2: Identifying wave patterns is key to predicting market movements

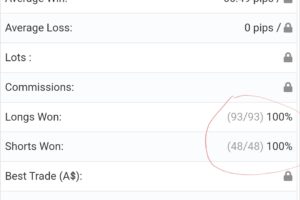

The second principle of wave theory is that identifying wave patterns is key to predicting market movements. Traders and investors can use specific wave patterns, such as Dib waves, to analyze and forecast market trends. These patterns are formed by combining impulse waves and corrective waves in a specific sequence, and they can be used to determine potential entry and exit points in the market. By using technical analysis to identify these wave patterns, traders can make more informed trading decisions and increase their chances of success. However, it is important to note that identifying wave patterns can be complex, and traders should have a solid understanding of wave analysis before attempting to use this strategy.

Principle 3: Risk management is key

The third principle of wave theory is that risk management is key. While wave theory can help traders identify potential entry and exit points, there is always a risk of losses. Traders must always have a clear risk management plan in place to minimize their losses and protect their capital.

Principle 4: Patience and discipline are essential

The fourth and final principle of wave theory is that patience and discipline are essential. Trading using wave theory requires a long-term perspective and the ability to stay disciplined even during periods of market volatility. Traders must be patient and wait for the right opportunities to present themselves, rather than trying to force trades or chase after profits.

In conclusion, learning how to trade using The Dib wave theory can be a valuable tool for traders and investors. By understanding the principles of wave theory and using technical analysis to predict market movements, traders can make informed trading decisions and minimize their risks. However, it is important to remember that no trading strategy is foolproof, and there is always a risk of losses. Traders must always have a clear risk management plan in place and remain disciplined and patient to succeed in the markets.

Leave A Reply

You must be logged in to post a comment.

1 Comment

thank you